Education & Resources

A Risk Management Solution

What is a captive insurance company?

A captive insurance company is a limited-purpose, licensed insurance company formed by businesses for the express purpose of insuring risks inherent in the associated business as an alternative to retail insurance markets. Captives can offer cost savings by eliminating or decreasing administrative costs and broker commissions. Further, the premiums can be invested to enhance a company’s financial strength generated by underwriting profits.

Why companies form captives

A captive allows the company to change the financing mechanism in order to trap and accrue the greatest amount of money possible to pay for claims and liabilities. This allows the business to stabilize rates long-term by partially underwriting third-party commercial insurance coverages as well as underinsured and/or uninsured risk exposures.

Who should consider forming a captive?

A company that has an above-average risk profile, the financial wherewithal and a long-term time horizon of at least 3 to 5 years is a good candidate to form a captive insurance company.

In our experience, for a captive program to be economically viable, a general rule of thumb is for businesses to pay premiums in excess of $500,000 per year, due to the inherent costs to form and operate a captive.

What does a typical client look like?

Captives have been a common risk management alternative among Fortune 500 companies, as well as other large enterprises, for over fifty years. However, mid-market businesses from a range of industries are now using captives as a solution to mitigate risk inherent in their businesses.

Where are captives formed?

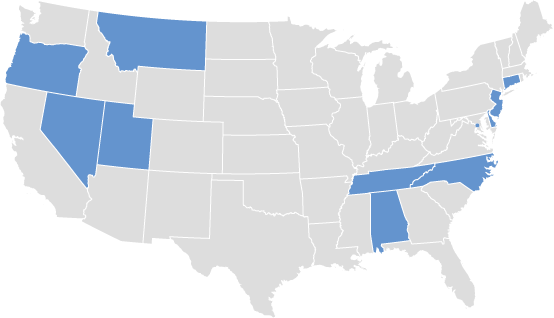

A captive insurance company must be licensed in a domicile, whether it be a U.S. state or a foreign jurisdiction, that has captive regulations that support the organization’s business plan.

Domicile selection for a captive is multifaceted, involving location, infrastructure, legislation, taxation, economic and political stability and regulatory climate.

Captive Planning is a licensed captive manager in the following domiciles: Alabama, Connecticut, Delaware, District of Columbia, Montana, Nevada, New Jersey, North Carolina, Oregon, San Jose, Tennessee, and Utah.